If you’re on the hunt for your dream condo, you may have come across terms that seem confusing, especially if you’re a first-time buyer. While it's perfectly normal to know only some of the terms associated with real estate, having a grasp of essential financial terms for condo buyers can give you a significant advantage in your search.

Fret not, because Empire East is here to help walk you through the essentials as you navigate the process of buying your first home. This article will break down the key financial terms you’re likely to encounter during your condo-hunting journey. By understanding these concepts, you’ll be better equipped to make informed decisions and confidently seal the deal on your new property.

RFO Properties

Ready for Occupancy (RFO) properties are condominiums that are completed and ready for immediate move-in. For buyers eager to settle into their new homes without the wait, RFO units present an attractive option.

Empire East offers an impressive selection of RFO properties that allows buyers to experience their new homes firsthand before committing. By choosing an RFO unit, you can avoid the uncertainties of construction delays and enjoy a fully realized living space right away.

Pre-selling Properties

Pre-selling properties are condominium units that can be purchased before construction is complete. This option allows buyers to secure a home early, often at prices lower than those of completed units. This makes it an appealing choice for many.

At Empire East, we design our pre-selling properties, carefully considering their locations to maximize convenience and lifestyle benefits. When you invest during the pre-selling phase, you lock in competitive prices, which can lead to substantial appreciation by the time your unit is ready for turnover.

We also enhance your home-buying experience with attractive financial options, including 0% down payment and 0% interest on monthly amortizations. This approach makes it easier for you to invest in your future home without straining your finances.

Down Payment

A down payment is the initial amount paid when purchasing a condominium. This upfront payment not only secures the property but also influences the amount of financing needed, such as through a bank loan.

A larger down payment can significantly reduce monthly amortization and interest rates, making the overall purchase more affordable in the long run. For instance, if you make a down payment of 20% on a condo priced at ₱4,000,000, your down payment would be ₱800,000. At Empire East, a downpayment is a one-time payment. It can't be paid in installments. It must be paid after paying the reservation fee.

When you buy a property with us at Empire East, you are only required to pay a down payment for our RFO units. Once this down payment is made along with your reservation, you can move in at your convenience. This allows you to move into your new home once it’s ready!

Amortization

Amortization is the process of gradually repaying a loan over a specified period, which includes both principal and interest payments. The goal is to fully pay off the loan by the end of its term.

This is where choosing Empire East becomes a great advantage because we offer 0% interest on our in house terms, making it easier for you to manage your financial commitments without the added burden of interest costs.

Financing Options

Condo buyers have a variety of financing options at their disposal, including bank loans, in-house financing, and government programs. Each option presents unique benefits and qualifications, making it essential to consider all available choices.

Empire East partners with reputable financial institutions to provide competitive financing solutions customized to meet your needs. Our team is ready to assist you in navigating the selection process, ensuring you find a financing option that aligns with your financial objectives and lifestyle.

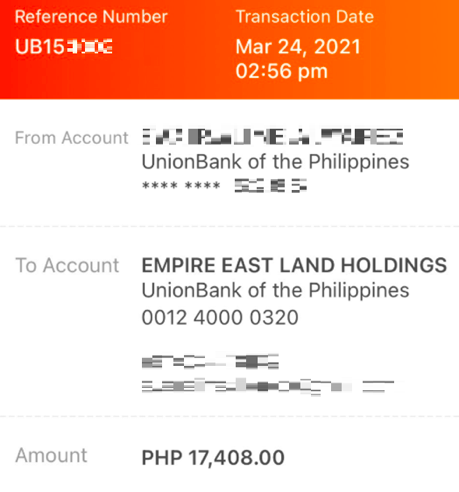

We make sure to provide various other payment methods like the following:

- Debit/Credit Card (Exclusive for Reservation Fee only)

- Post-dated checks

- Online/Mobile Banking

- Bank Over-the-Counter

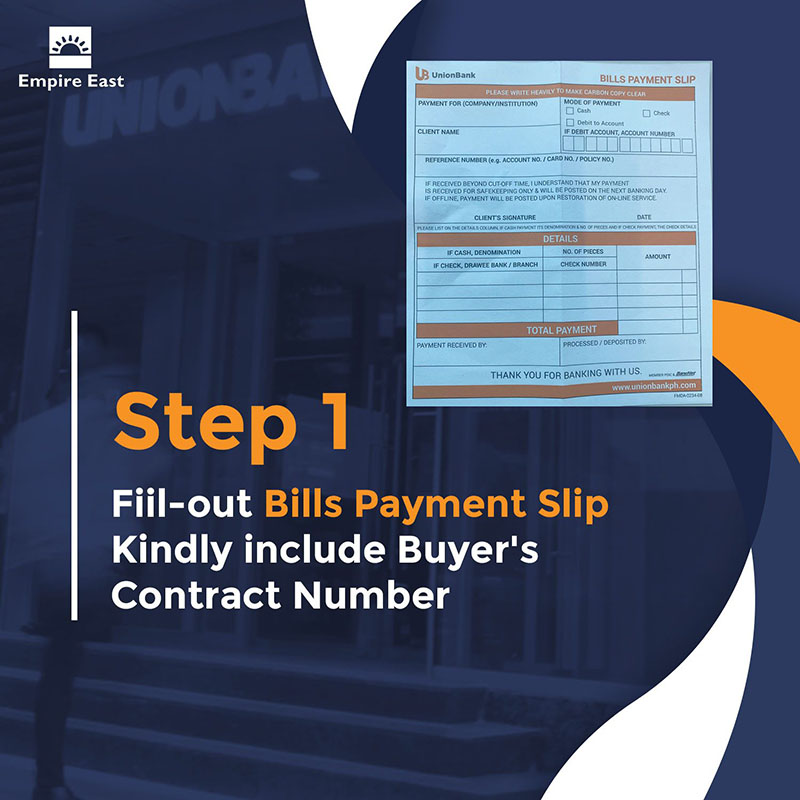

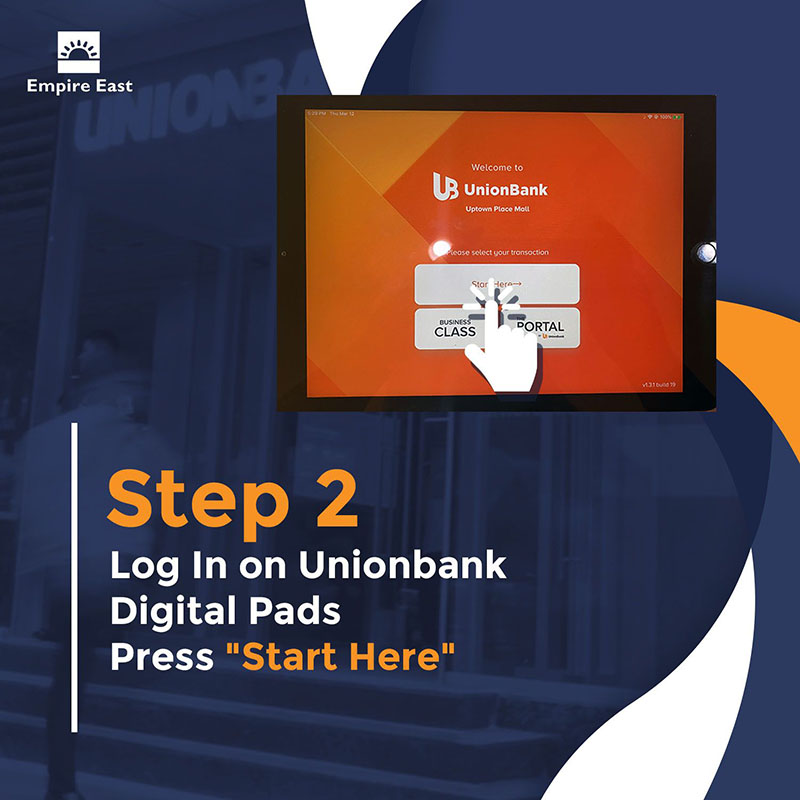

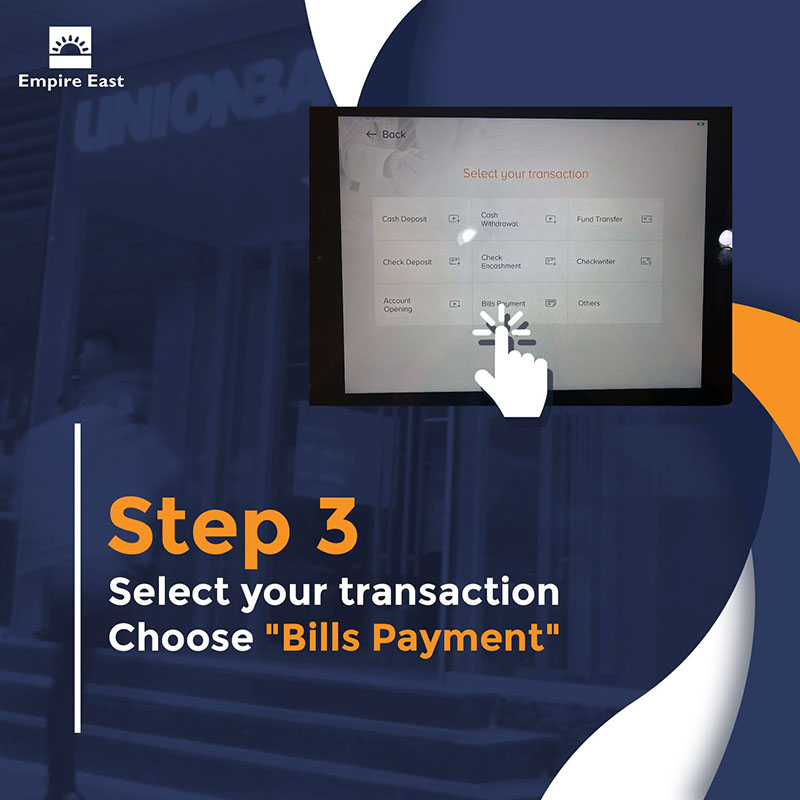

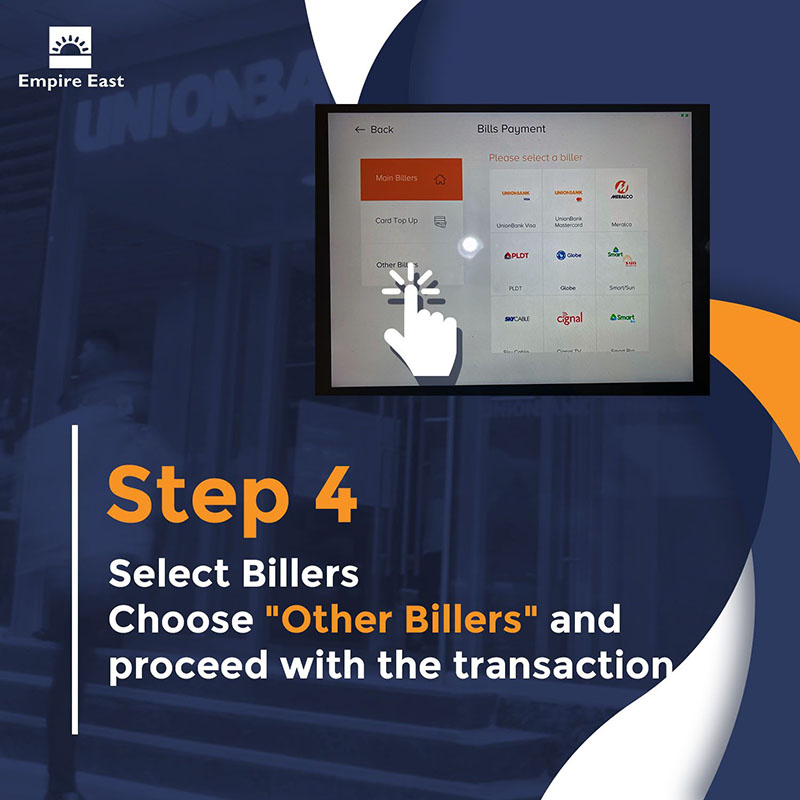

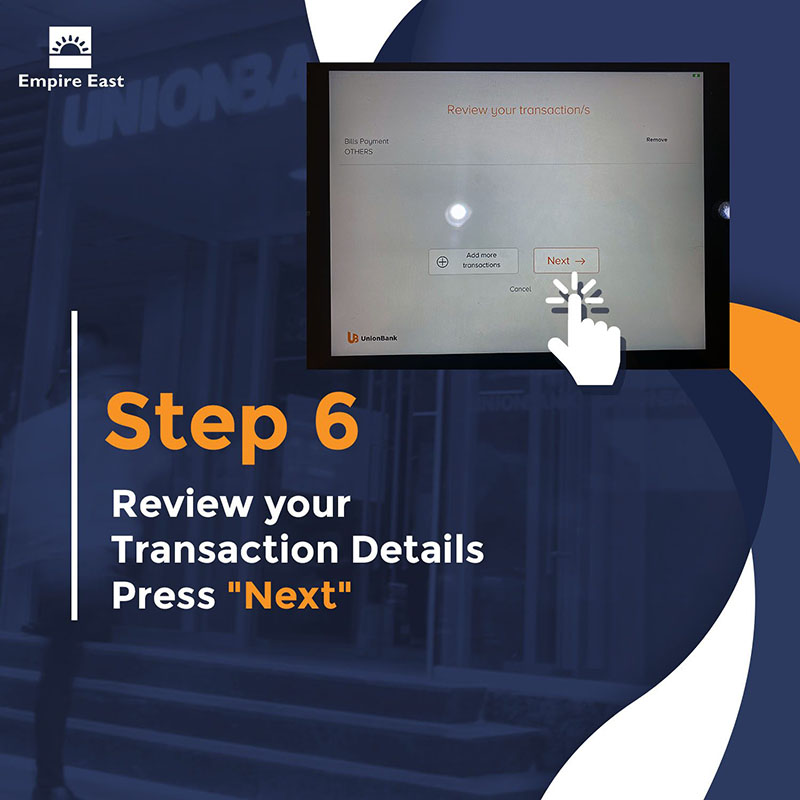

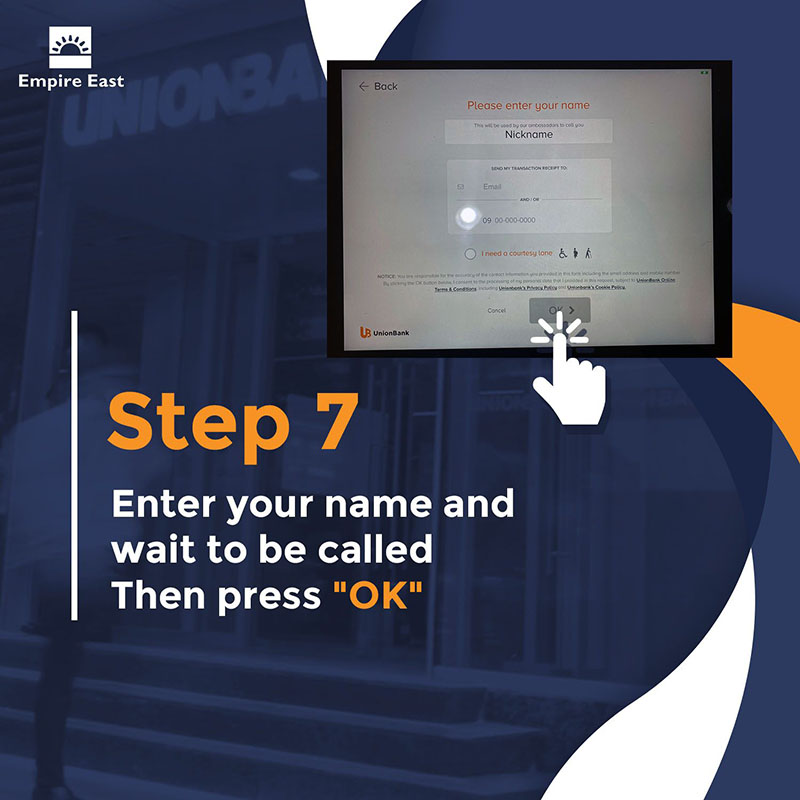

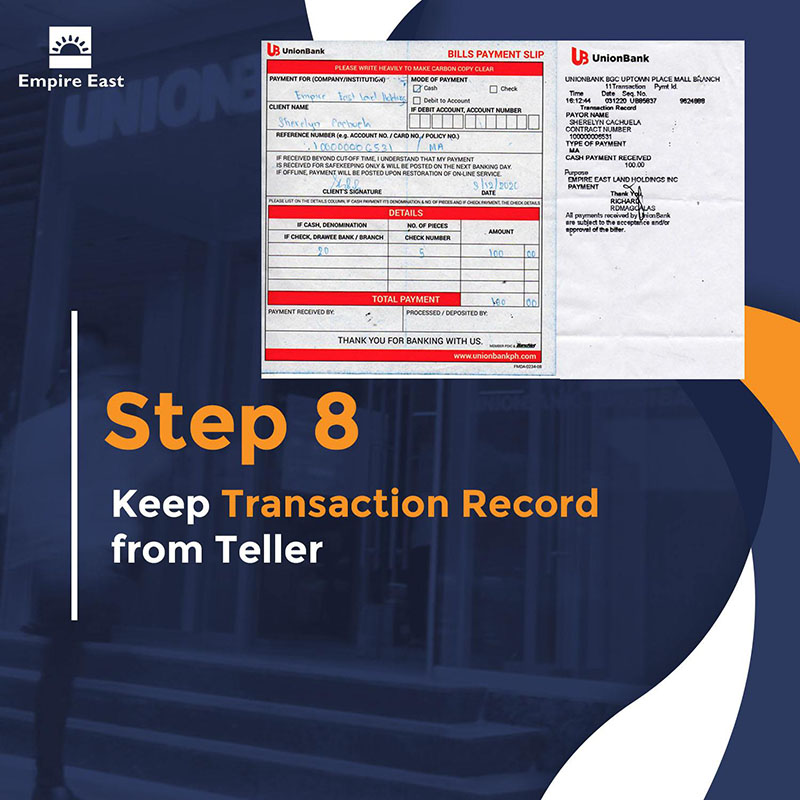

- UnionBank & BDO Bills Payment

- E-Wallet

- Direct Deposit & Fund Transfer

- Online Payment Aggregators (Aqwire and Dragonpay)

HOA Dues

Homeowners Association (HOA) dues are fees collected from property owners to maintain shared amenities and services within a condominium community. These monthly dues typically cover expenses such as landscaping, security, and the upkeep of common areas like pools and gyms, ensuring that residents can enjoy these facilities.

At Empire East, we prioritize transparency regarding these fees, making sure buyers are fully informed about the costs associated with their new homes. These dues contribute to a well-maintained and secure living environment, significantly enhancing your overall living experience.

Real Property Taxes

Real property taxes or amilyar are government-imposed levies on property ownership, calculated based on the property's assessed value. These taxes are usually paid annually and can vary depending on the property's location. These are based on the zonal value of the property, which is determined by local government assessments.

At Empire East, we encourage buyers to include real property taxes in their overall budget. Understanding how these taxes are assessed is crucial for making informed financial decisions. Our team is always available to assist you in estimating these costs, helping you prepare for homeownership with greater confidence and clarity. By factoring in these taxes, you can better manage your finances and enjoy a smoother transition into your new home.

Key Takeaway

Understanding these essential financial terms for condo buyers is important if you’re planning to purchase your new home soon. If you're ready to take the next step in your condo-buying journey, Empire East is here to help.

With our team of experienced real estate professionals, flexible financing options, and a range of high-quality developments across Metro Manila, Empire East is the perfect partner for aspiring homeowners looking to find their dream condo without breaking the bank. Reach out to us today to get started!

Empire East Highland City

Empire East Highland City

The Paddington Place

The Paddington Place

Mango Tree Residences

Mango Tree Residences

Kasara Urban Resort Residences

Kasara Urban Resort Residences

Covent Garden

Covent Garden

The Rochester

The Rochester

Pioneer Woodlands

Pioneer Woodlands

Little Baguio Terraces

Little Baguio Terraces

San Lorenzo Place

San Lorenzo Place